Contents:

An exception to this is when negative working capital arises in businesses that generate cash very quickly and can sell products to their customers before paying their suppliers. The working capital ratio is sometimes referred to as the current ratio as the measure is generally calculated quarterly, that is, on a “current” short-term basis. A positive net working capital means that the company is able to pay all its debts without having to take on further loans or investments. The company has enough cash to repay its dues, while also focusing on improving the business. Conversely, a negative NWC is when a company’s liabilities are far greater than what it can afford to pay. In a situation like this, the company would need to secure investments to avoid going bankrupt.

These projections can help you identify months when you have more money going out than coming in, and when that cash flow gap is widest. Parts of these calculations could require making educated guesses about the future. While you can be guided by historical results, you’ll also need to factor in new contracts you expect to sign or the possible loss of important customers. It can be particularly challenging to make accurate projections if your company is growing rapidly.

Business Tips – NOTE Fair Work, Gender, Pay secrecy, Respect Liability – legislation changes 2023 to note carefully!

Your money should be working for you as hard as your employees are. For example, developing new products and services, looking for new markets, planning ahead to remain competitive. The first is to compare the calculated ratio with the companies own historical records to spot trends. A stable ratio means that money is flowing in and out of the business smoothly. It gives a holistic view of any company and indicates the financial health of future survival.

The Working Capital Ratio and a Company’s Management – Investopedia

The Working Capital Ratio and a Company’s Management.

Posted: Sat, 25 Mar 2017 07:49:27 GMT [source]

If this company’s liabilities exceeded their assets, the working capital would be negative and therefore lack short-term liquidity for now. As mentioned above, the net working capital ratio is a measure of a firm’s liquidity or how quickly it can convert its assets to cash. If that happens, then the business would have to raise financing to pay off even its short-term debt or current liabilities. The values of the denominator and numerator of net working capital ratio are available on the balance sheet of the company. A company has positive working capital if it has enough cash, accounts receivable and other liquid assets to cover its short-term obligations, such as accounts payable and short-term debt. A working capital ratio is a metric that reflects a company’s ability to pay off its current liabilities with its current assets.

Working Capital Ratio Analysis

Working capital is calculated by taking a company’s current assets and deducting current liabilities. For instance, if a company has current assets of $100,000 and current liabilities of $80,000, then its working capital would be $20,000. Common examples of current assets include cash, accounts receivable, and inventory. Examples of current liabilities include accounts payable, short-term debt payments, or the current portion of deferred revenue. Working capital is the funds a business needs to support its short-term operating activities.

Working Capital Needs Calculator Citizens – Investor Relations

Working Capital Needs Calculator Citizens.

Posted: Tue, 06 Dec 2022 15:12:38 GMT [source]

You simply need to find the difference between the working capital for this year and the working capital of the previous year. Alternatively, you can calculate the difference between the assets and liabilities from the previous year and the current year. The difference in liabilities can be subtracted from the difference in assets. Internally, your working capital tells you where you stand financially. It helps you ascertain all the assets you have that can be liquidated. It also gives you a better understanding of how you intend to repay your dues.

Liquidity

Generally speaking, an asset is anything of financial value that your company owns. However, for an asset to be considered current or liquid, it must be something that can be easily and quickly exchanged for cash in the short term. In other cases, inventory goes down while cash goes up from sales, with little short-term increase in net working capital. Use term equipment loans or commercial real estate mortgages to finance equipment and buildings.

In order to better understand the ways in which accounting equation, changes in NWC, and the NWC ratio are used, let us consider the example of fictional business Company X and its efforts to monitor and manage its liquidity. These two ratios are also used to compare a business’s current performance with prior quarters and to compare the business with other companies, making it useful for lenders and investors. Deferred revenue, such as advance payments from customers for goods or services not yet delivered. At the risk of stating the obvious, that’s because cash is the very thing the cash flow statement is trying to solve for.

How do you calculate net working capital?

These include land, real estate, and some collectibles, which can take a long time to find a buyer for. You create accounts receivable when you sell to customers and collect the cash later. It won’t decrease until production goes down, which may be very, very far in the future. A ratio above two may mean you can invest cash in your business, pay down debt, or distribute it to owners. Run a cash flow projection to confirm this and decide whether you want to keep the cash for safety or invest it for higher profits. This indicates whether a company possesses enough short-term assets to cover short-term debt.

The ratio is used by lenders and creditors when deciding whether to extend credit to a borrower. In simple terms, it’s the difference between your company’s current assets and its liabilities, such as loans to repay. Keep reading to find out more about working capital and current ratio. When a working capital calculation is positive, this means the company’s current assets are greater than its current liabilities. The company has more than enough resources to cover its short-term debt, and there is residual cash should all current assets be liquidated to pay this debt. There are a few different ways to calculate working capital, but the most common is to subtract current liabilities from current assets.

That involves renegotiating payment terms with suppliers to extend the amount of time you have to pay debts, using dynamic discounting or supply chain finance, and streamlining accounts payable processes. A company can improve its working capital by increasing its current assets. Working capital is important because it is necessary for businesses to remain solvent.

- It might indicate that the business has too much inventory or is not investing its excess cash.

- The idea is to have enough to pay all loans, while also leaving room to grow profitably and invest in high-return ventures.

- The working capital ratio is sometimes referred to as the current ratio as the measure is generally calculated quarterly, that is, on a “current” short-term basis.

- This is represented by combining the accounts receivable and inventories, less accounts payable.

- Volopay is tied up with multiple vendors who offer such competitive prices.

- Working capital can be very insightful to determine a company’s short-term health.

Tally up all the debts, expenses, and other financial obligations expected for your business throughout the year or your operating cycle. This is part of the funding needed for growth than companies don’t anticipate. Increases in permanent working capital need funded with long-term debt or equity. Using your line of credit or credit cards to finance working capital for growth can lead to a cash crunch. When profits aren’t as high as projected, the owner doesn’t have the cash to pay off the short-term debt.

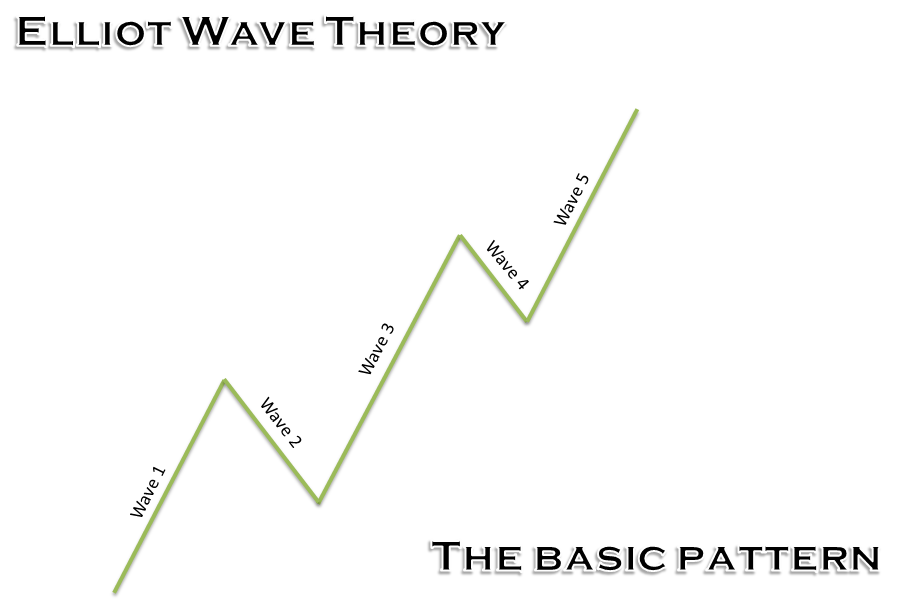

For example, if it takes an appliance retailer 35 https://1investing.in/s on average to sell inventory and another 28 days on average to collect the cash post-sale, the operating cycle is 63 days. For example, if all of Noodles & Co’s accrued expenses and payables are due next month, while all the receivables are expected 6 months from now, there would be a liquidity problem at Noodles. The ratio refers to the proportional relationship between assets and liabilities.

Working Capital: Formula, Components, and Limitations – Investopedia

Working Capital: Formula, Components, and Limitations.

Posted: Sun, 26 Mar 2017 08:17:41 GMT [source]

That short-term debt suddenly becomes very expensive due to late fees, penalty interest rates, damage to the company’s credit record, and decreases to the owner’s credit score. The key to improving net working capital is to increase short term assets or decrease short term liabilities. I’ll show you effective ways to do this and ineffective strategies to avoid. You won’t receive and keep the cash from some assets traditionally classified as current. For example, your accounts receivable and payable constantly get replaced with new ones, so they don’t provide as much cash as you may think.

The software can set up reminders for your clients to pay their dues as soon as an invoice is received and/or closer to the payment date. It acts as a data collection and assortment software, which also does your working capital accounting. If your clients are paying on time, but your NWC balance sheet isn’t improving, then it might be the payment cycle that needs to be revised. For the company’s well-being, it must be able to repay the liabilities with the assets without having to resource more financing from the market. If a company needs to borrow funds to meet its current liabilities, its financial condition is weak. The working capital ratio is a measurement of a company’s short-term capability of paying its financial obligations.